Where are we?

Bitcoin stands at its own provincial section of the internet. Ready to do battle with a hacker-mindset mirth-attitude versus an orthodox arrant opponent. Ironically this child-like informality has allowed bitcoin and its older brethren to develop. Older brothers like BitTorrent. BitTorrent was the dynamic response of a community to creepingly tight strangulation on file-sharing services. BitTorrent was one of many competing decentralised file-sharing systems at the time. It chanced the lottery for whatever reasons and won out.

Bitcoin challenges finance. BitTorrent challenges publishing.

Both are decentralised systems. In BitTorrent, you download a movie from other peers in that network. Much like bitcoin. However, a downloader has to know which movie file he wishes to download. Much like bitcoin. In Bitcoin, you have to know who you’re sending money to before you send the money. If you could not specify recipients, bitcoin would be more exciting but not practically useful!

Geek pride

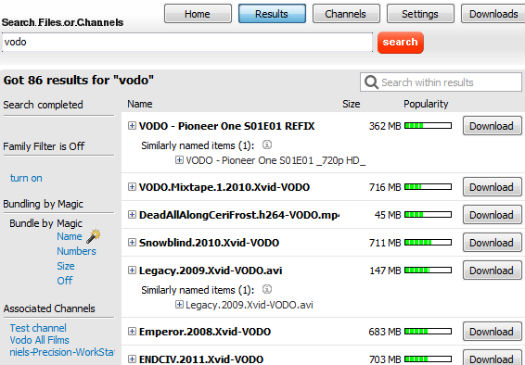

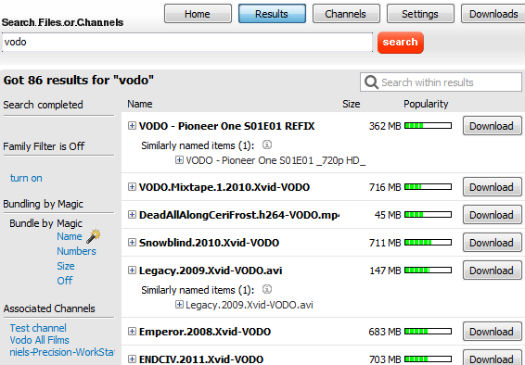

BitTorrent then has third party websites where people can upload links (which only work in the BitTorrent software) to downloadable files inside the BitTorrent mini-internet. These websites offer a searchable index which users can then come to discover which file they wish to download. They click the download-link (called a magnet-URI) and the download starts. The BitTorrent software is then able to discover other peers inside the network using its decentralised process.

There are many competing third-party services. Shut one down, and another fills its place. The Pirate Bay is one of these. Their notoriety spawned a political party. And boosted a growing subculture of people versed in the issues surrounding individual rights and access to information. A generation raised and living in cyberspace. All across the world, people are asserting themselves, reclaiming the word pirate as new epaulettes as the insignia of the geek. Homosexuals reclaimed gay. Blacks reclaimed nigger. We’re reclaiming pirate.

Originally intended as a badge of shame, the pink triangle (often inverted from its Nazi usage) has been reclaimed as an international symbol of gay pride and the gay rights movement, and is second in popularity only to the rainbow flag.

Managing complex systems

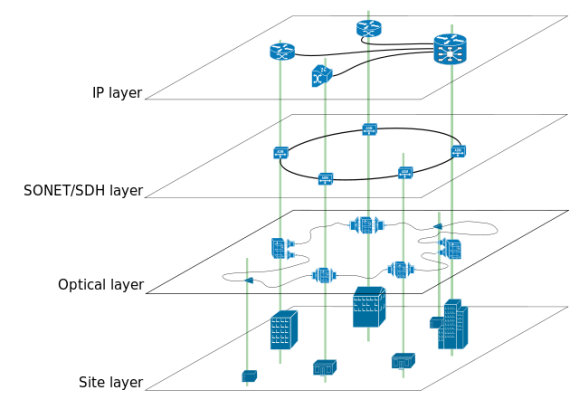

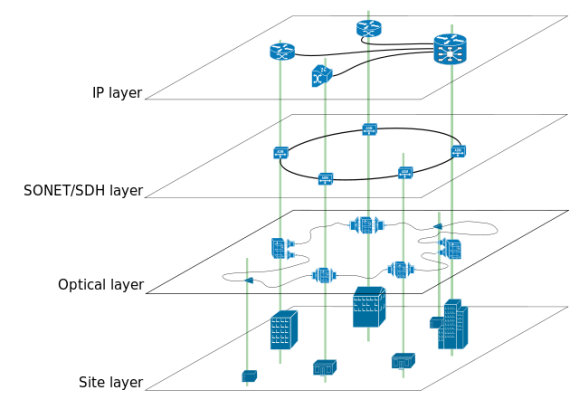

Computer systems often are designed in layers. A layered system is easier to grapple by a team. Each developer works his own turf in graduation from systems developers programming hardware, to application developers programming user software. People have diverse skills and propensities. This alignment permits coders to choose their layer and tend his turf to perfection, without concerning himself with the neighbours.

Banks are layered systems. There’s an ecosystem of services and agreements that make the arrangement work without one dictator at the top. Otherwise you get a monolithic system worse than the bitcoind sourcecode.

BitTorrent is a layered system with those third-party indexing services at the top. Those services can be stomped out but more daisies will spring up. They are the weak-links of the BitTorrent world. The equivalent to bitcoin’s exchanges. The choke-point for the multi-headed decentralised hydra.

“Tribler Makes BitTorrent Impossible to Shut Down”

Discussion has started on whether a new network overlaying the BitTorrent network can resolve this weakness. Fix the issue and attain a 100% resilience stat. Could we make an overlay network?

Enter Tribler:

Tribler doesn’t require torrent sites to find or download content, as it is based on pure peer-to-peer communication. “The only way to take it down is to take the Internet down,” the lead researcher says.

“Our key scientific quest is facilitating unbounded information sharing,” Tribler leader Dr. Pouwelse tells TorrentFreak. “We simply don’t like unreliable servers. With Tribler we have achieved zero-seconds downtime over the past six years, all because we don’t rely on shaky foundations such as DNS, web servers or search portals.”

Downloading torrents through Tribler is completely decentralised. The client searches for results within the network and pulls in the metadata from other peers.

Keeping in consistent lockstep with other systems, bitcoin is layered. It has a system, protocol, clients, interfaces and services. But all of the upper levels are missing. We haven’t created them yet. It will be a long time before we develop the knowledge and live the experience that we can wield as tools to tackle these problems.

Even the mental models are not yet there. Read the early papers by Newton and Leibniz on calculus. They are almost incomprehensible. The mental abstractions and models we use now did not exist. It took centuries until calculus was ready for high-school.

Electrum and Stratum are two early attempts at creating overlay networks that are exciting and fresh. Users can interact with specialised supernodes to read the blockchain, sparing themselves the expense of running a resource hungry local node. Today everyone uses trusted mail operators. Tomorrow everyone will rely on trusted supernodes for their blockchain needs. Electrum and Stratum are the first ghostly shimmers of bitcoin’s future direction. Imperceptible and easy to overlook.

Clearing and Settlement Mechanism

The SEPA (Single Euro Payments Area) initiative for European financial infrastructure improves the efficiency of cross border payments by consolidating fragmented banking systems into a single standard. This system is implemented by all banks within the SEPA region.

The Clearing and Settlement Mechanism (CSM) underlies SEPA payments. Clearing is a contractual obligation to fulfill a trade. The bank commits to a transaction until it is ‘settled’. Clearing is necessary because the speed is much faster than the cycle time for completing the underlying transaction (settlement). If bank A sends 20 EUR to bank B, and bank B sends 10 EUR to bank A, then during the settlement process 10 EUR will be settled from bank A to bank B. In practice the volumes are much higher.

Bitcoin is a settlement system. We need clearing systems. Systems like Electrum/Stratum will allow the network to scale, while clearing systems will fill in bitcoin’s blanks. Instant anonymous small micropayments at no or low fees. Currently bitcoin transfers are fast but not instant, private not anonymous, cent-value not micro-transactional, and low fees not no-fees. A good clearing system will connect those final dots.

Bitcoin’s future clearing system has no defined spec. Quite how it will look is not known. Could it be a third party service or a Tribler-like system? Would the adopted clearing system be based on a first-mover advantage entrenched by the pull of network effects, or one that arises out of a competitive market based on its merits? Only Nostradamus knows.

Powers combined

Such a clearing system would have massive benefits for incentivising models on the internet. Reward culture at a click. Everyday videos are uploaded to community video sites like YouTube or Vimeo. Videos routinely gain audiences in the millions. Imagine one of these videos with a 100 million views. If that uploader got $0.01 for every view, he would have $1 million. Click-funded culture.

This hypothetical bitcoin-clearing system could be built into a decentralised content overlay network like that of Tribler. Funds could be aggregated towards uploaders, trickling around the network funding publishers of the media.

Tiny payments for fractional bitcoin amounts would encourage people to provide their bandwidth to help spread the love, rather than leeching and running. In school the teacher would give a chocolate bar to the good kids. In BitTorrent we would give $$$ to the good seeders. More bandwidth would be provided to the BitTorrent network, speeding up download times. Faster downloads and the natural resiliency would encourage people towards torrents. Bitcoin would benefit too, if simply from a step up in users and a richer economy.

Tit for tat is an effective strategy for encouraging uploaders. It works well to have two parties building trust by returning a favour to encourage further goodwill. Anti-social hoarders in the network are punished by being shut-off from bandwidth. Co-operative uploaders are rewarded with access to larger bandwidth and hence faster downloads.

This strategy could equally work well with one form of wealth (bandwidth) substituted for a purer form (money). It would have implications that lead to the new development of unusual technologies and enthralling ideas.

And together we reclaim culture. Culture will forever change. The read-only world is finished. Read-write culture begins now. Reconverging on the patronage system is step one.

A little over 217,750 bitcoins were issued (or “generated”, or “mined”) during the month worth nearly $1.1 million using the average daily valuation of $5.12. For the miners paying typical electric rates the current mining profitability is covering the cost of electricity but otherwise little else, especially if considering the cost to amortize typical mining hardware as well. The difficulty did increase but only around 5% for the month. With commercial availability of FPGA designs, miners will be likely see another squeeze on margins unless the exchange rate jumps up.

A little over 217,750 bitcoins were issued (or “generated”, or “mined”) during the month worth nearly $1.1 million using the average daily valuation of $5.12. For the miners paying typical electric rates the current mining profitability is covering the cost of electricity but otherwise little else, especially if considering the cost to amortize typical mining hardware as well. The difficulty did increase but only around 5% for the month. With commercial availability of FPGA designs, miners will be likely see another squeeze on margins unless the exchange rate jumps up. With continued attention being given Bitcoin — the latest rush coming as the result of comments from Google’s Executive Chairman, the currency continues to gain mindshare.

With continued attention being given Bitcoin — the latest rush coming as the result of comments from Google’s Executive Chairman, the currency continues to gain mindshare.

BitInstant accepts USD codes from some of these exchanges, at a discount, for its service which is used by many to move USD funds between exchanges. For instance, a trader that wishes to move USD funds from Crypto X Change to Bitcoinica might use BitInstant for making that transfer. For most smaller transactions (e.g., under $1,000) the fee charged by BitInstant will likely be significantly less than if the transfer occurred using a bank wire.

BitInstant accepts USD codes from some of these exchanges, at a discount, for its service which is used by many to move USD funds between exchanges. For instance, a trader that wishes to move USD funds from Crypto X Change to Bitcoinica might use BitInstant for making that transfer. For most smaller transactions (e.g., under $1,000) the fee charged by BitInstant will likely be significantly less than if the transfer occurred using a bank wire.

Tags: GLBSE

Tags: GLBSE